Understanding LISA interest rates: a comprehensive guide

Understanding LISA interest rates is crucial for individuals looking to make informed d...

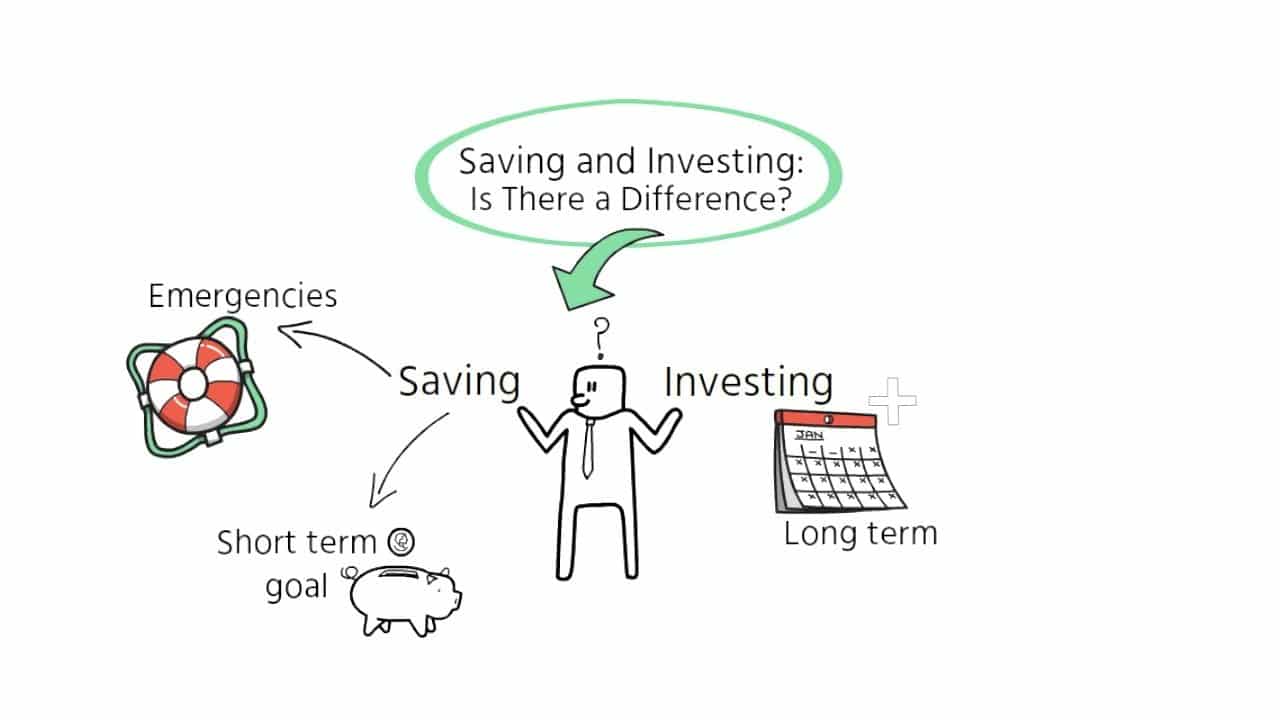

At its most simple, saving is normally something you do for short-term goals or to cover yourself in emergencies. Investing, on the other hand, is done for the long term with an expectation of a return.

Saving and investing is there a difference at its most simple, saving is normally something you do for a short-term financial goal or to cover yourself in emergencies.

Investing on the other hand is done for the long term with an expectation of a return. Once you’ve set your financial goals, saving and investing will be crucial to achieving them.

Each will play an important but distinct path on your journey towards greater financial freedom. With both of these techniques you’ll be putting money aside but each will be for different purposes.

Saving

Save it after you’ve covered your budget for the month and spent money on the important basic things such as rent, your student loan, some entertainment and of course groceries you’ll hopefully have some money left over if you put this towards your savings this will typically help you reach your short-term financial goals.

For most people this will mean having enough money to cover yourself in an emergency. Typically around three months worth of your basic expenses budget this money can be left in a savings account meaning that it earns little interest but is easily accessible for when you might need it most.

Other short-term goals could be to buy a new car or maybe save towards a first down payment for a house.

Investing

Investing once you start investing your money you’ll be actively placing your money into the markets this means that you’ll start to expect a return on your investments when you invest in the stock market. You’ll generally be purchasing a small portion of a company by buying a bond you purchase the debt of a government or a company with a fund purchase you’ll be paying for a basket of stocks.

Bonds or cash or possibly a blend of each depending on the aims and objectives of that particular fund by investing your money like this you have the chance to earn a return which means your money can grow and beat inflation.

Investors generally hope to earn more money from their investment than they would typically get from a savings account.

Risks

Is investing riskier than saving?

Money placed into a savings account will generally be very safe. The financial services compensation scheme run by the FCA protects deposits and savings up to £85,000. The downside is that the interest rates are low. Mostly under the rate of inflation over time.This means that the real value of your money will diminish while you may be able to get higher returns through investing this also comes with risks if you’ve invested in a stock for example and the company doesn’t do as well as the market thought it would then the share price could go down meaning that you might even lose money.

Typically the market will move up and down on a daily basis meaning the value of your assets will change with it.

You can take account of this risk by trying to diversify your investments and aiming to hold onto them for the long term. This allows you to spread your risk across different areas and hopefully ride out any short-term fluctuations in the price.

Even with these strategies though it’s important to know that no investment is entirely free of risk. Over the long run though say 10 to 20 years markets always rise.