Tickr tape

This fresh-faced robo only started life at the beginning of 2019 and is focused on what’s called impact investing. While yet another term in the investment lexicon, it more accurately describes what Tickr is about — investing your money to make a positive impact in the world. This means the options aren’t restricted to just one issue, such as climate change, but a broader range of environmental and social issues such as gender equality.

Tickr does a lot of what other robos do — it offers access to ETFs through ISAs and General Investment Accounts (GIAs). You can make one-off contributions or invest through a direct debit and it has an easy-to-use app. But what Tickr does differently is that it brings investors closer to the underlying investments and the impact they have on the companies they invest in.

It’s aimed primarily at millennials. In an industry that’s often perceived as murky and unclear, Tickr puts a lot of effort into demystifying how their portfolios work — whether it’s in Tickr’s favour or not — which is a refreshingly open approach.

Tick ‘n’ mix

Tickr’s aim is to get millennials investing for the first time with investment options that resonate with them. There are three investment themes to choose from: Climate Change, Disruptive Technology and Equality. Investors can choose a theme or a mix of all three in the Combo theme.

Within each theme, there’s a short list of sub-themes. For example, the Climate change sub-themes are Global Water and Clean Energy. There’s a lot of additional info available that’s not normally provided by robo-advisers (or indeed any investment company) which helps to see what’s under the bonnet. It’s a good move that will appeal to sceptical millennials.

Tickr lists the main companies invested in its themes and sub-themes. If there’s an unknown or perhaps contentious company, it has videos outlining what the company does, the positive impact it has and why it’s being included in the theme. This helps to bring companies to life, giving them a platform to tell their story and connecting investors to their investments – something we think should be adopted more widely across financial services.

Co-founder (and owner of fun-to-say surname) Tom McGillycuddy noted that after years of being in the investment management industry one of the most important events was meeting someone who had benefited from a company he was investing in – and that was the light-bulb moment for marketing Tickr.

‘One day, I was speaking to an Indian family that was being helped by one of the companies I was investing in, and I thought this is exactly the sort of story that would get my friends investing.’

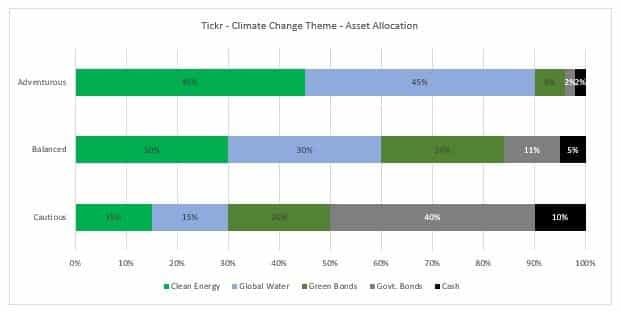

The sub-themes and government and green bonds make up the overall theme. The amount invested into bonds or sub-themes depends on the risk rating chosen, (cautious, balanced or adventurous). The more risk you take, the more of your investment goes into the themes and less into bonds.

As the above figures show, cautious portfolios have a much higher weighting of green and government bonds. Green bonds, also known as Climate Bonds, are bonds specifically earmarked for use in climate and environmental projects.

The underlying investments are all iShare ETFs (Tickr says this is by coincidence rather than choice) and it’s Tickr’s responsibility to make sure the underlying investments in the ETFs reflect their values and to switch ETFs if they don’t. To do this, Tickr has a small investment committee that monitors and reviews the underlying investments to make sure they remain suitable for the overarching themes and has already replaced ETFs where that proved not to be the case.

The current number of themes could expand in the future with Matt Latham telling us that Tickr is always on the lookout for new ideas that may be suitable. He also mentioned that Tickr is looking to broaden its product range by adding a Sipp and Jisa in 2020.

Tickr experience

Tickr is an app-based robo-adviser with high production values. Signing up and opening an account is as smooth as silk and there is plenty of additional information to reassure investors they’re making informed decisions. We also found the chat and email services useful, though there were a few gaps in some of the FAQs.

It would also be helpful to get information on how the different portfolios assets are balanced between the different risk profiles. We asked for and were told promptly, but couldn’t find it online.

Tickr symbols

Tickr charges a flat 0.7% for all its customers regardless of how much they invest, and portfolios generally cost 0.3%. The charges are a bit higher than others in the robo market, but eco options generally cost more and the difference isn’t huge.

Tickr’s aim is to get millennials investing for the first time and it’s working. Over 90% of its users are under 40 years old, 70% of them are first-time investors and 40% are female. It also encourages investors to refer friends with refer-a-friend rewards of £5 and the promise to plant two trees for every referral. It runs regular live and informal events where investors can meet the Tickr team to discuss impact investing and future developments over pizza and beer.

That’s the Tickr

Tickr is a refreshingly open and transparent robo advice proposition that stands out in what can, at times, be an industry without a great deal of differentiation. It’s clear in its ambitions and comes across as transparent and genuine.

Though we had some minor niggles along the way, such as not being able to access the app for short periods (something you might expect from a start-up fin-tech company), it works really well. The service was clear, succinct and personable and felt distinctly uncorporate – which hopefully they can maintain as they grow.

The amount of support material available is good and it often pops up at the right time — just as you’re thinking about searching for it. The suite of learning materials is quite broad but split into bite-size chunks with some familiar metaphors to help make learning about investing more engaging and interesting.

If you’re a first-time millennial investor, the research suggests you’ll be drawn to Tickr more than other robo advice offerings out there, but we suspect it’ll appeal to all types of investors and not just millennial first-timers.

The support material is good and embedded within the app, which itself is modern, clean and easy to use. Some gaps in product ranges and the higher-than-average overall cost brings our score for Tickr to a solid 3/5. Click here for a list of robos and here to run the robo calculator to find the right robo for you.