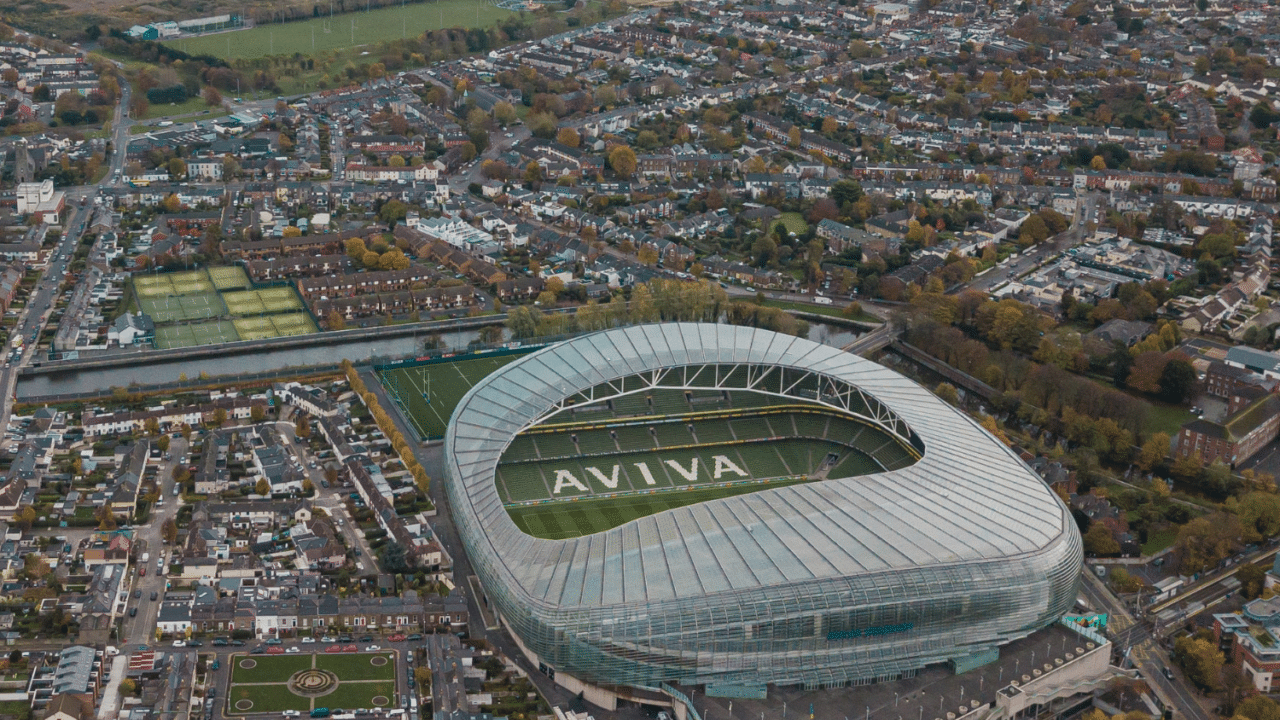

When you hear “Aviva“, your mind probably jumps to insurance. It’s a name synonymous with protecting your car or health in many households. But there’s more to Aviva than meets the eye. They’ve woven a direct-to-consumer investment platform right into their consumer portal. Alongside a suite of insurance products and policies, Aviva empowers consumers to hold investments across a general investment account, ISAs, pensions, and a junior ISA through its Wealthify subsidiary.

Who is Aviva for?

When it comes to serving a varied crowd, Aviva has it covered. They’re particularly great for people looking for a one-stop shop for all things finance, where investments are just one piece of the puzzle. It is especially accommodating to individuals who prefer a more hands-off investment approach. They offer plenty of choices without drowning you in too many options.

How do you get started with Aviva?

- Begin with Basics: Input your name, address, and National Insurance number.

- Decide Your Direction: Opt for the type of investment – be it ISAs, pensions, or other options.

- Risk Rundown: Fill out a brief questionnaire to gauge your comfort with investment risks.

- Investment Invitation: Aviva presents suggested investment choices in line with your risk profile.

- Financial Foundation: Determine how to fund your account, from direct transfers to periodic contributions.

- Double-Check Details: Take a moment to review everything before embarking on your investment adventure.

Once you’re signed up, it’s pretty easy to get going. The platform’s website is meticulously designed, offering clear and intuitive user interfaces with well-organised layouts and straightforward navigation. You’ll find the information or a tool you need without hassle.

Aviva brings a bunch of helpful tools and calculators to the table, like retirement planners, life insurance calculators, and financial personality profilers, all aimed at helping you easily map out your financial future. They’re made to be super user-friendly, giving you all the insights, you need without bogging you down with complicated details.

Aviva’s available investment choices

While Aviva may not boast the most extensive range of investments, it provides a solid assortment that’s sufficient. The investment choices are embedded within the context of a broader financial lifestyle, focusing on sufficiency and reliability rather than an overabundance of options. The availability of diverse tools and planners contributes to shaping a well-rounded investment experience tailored to individual needs.

So, expect a range of funds, pensions and retirement options, ISAs, and ESG options. There is also a link-up via the Junior ISA with a subsidiary platform, Wealthify.

What about fees and charges?

The fee information, while easily accessible, isn’t particularly well laid out, and it takes a few reviews to properly understand what you’ll pay for your account and investments. Unlike other platforms, there are no helpful sliders or calculators on the fees page.

- Annual Charge: Aviva’s annual charge for holding investments and money in your cash account is up to 0.40% of the invested value, decreasing for higher investment values:

- Up to £50,000: 0.40%

- £50,001 – £250,000: 0.35%

- £250,001 – £500,000: 0.25%

- Over £500,000: 0%

- Aviva Share Charge: This 0.40% charge applies to holding exchange-traded investments, capped at £120/year for SIPPs and £45/year for ISAs or Investment Accounts.

- Fund Manager Charge: Each fund has an individual management charge, visible in the Key Investor Information Document.

- Trading Charge: A fixed £7.50 is charged per trade for shares, ETFs, or investment trusts, with no charge for trading investment funds.

In summary

Aviva has successfully transcended its reputation as primarily an insurance provider, crafting a diverse and inclusive investment platform. Although basic in its investment offerings, the platform is enriched with an array of tools and planners, catering to those who view investments as part of a broader financial lifestyle.

While the investment choices may not be extensive, they are robust enough for consumers who prefer a less hands-on investment approach. The clear and intuitive website and the variety of helpful tools make Aviva a solid choice for individuals seeking a well-rounded, reliable platform. However, those desiring more autonomy and a broader range of investments might find more suitable alternatives elsewhere.

For those valuing simplicity, user-friendliness, and a direct approach to investments within a broader financial context, Aviva emerges as a viable contender.

Photo by Gabriel Ramos on Unsplash