interactive investor (ii) is the second biggest investment platform in the UK for direct customers, second only to market leader, Hargreaves Lansdown. The company was founded back in 1995, which for the Millennials or Gen Zers among you, makes it the same age as Timothée Chalamet and Dua Lipa. The platform now has over 400,000 customers and has circa £60bn in assets on the platform. In 2022 it was acquired by investment management firm, abrdn.

What does interactive investor cost?

One of the main differences between ii and its peers is that it charges a flat fee. Most platforms charge a percentage of the amount invested. ii believes a flat fee is more transparent and easier to understand.

The second difference is that the percentage fee for most platforms reduces as you invest more. Ii is different in that it offers a lower fee option for smaller investments.

Nice and simple so far, but this is where it gets a little more complicated. ii offers three options, each with different pricing and different features:

- The ‘most popular’ plan according to ii’s website is Investor. It costs £9.99 per month, it allows free regular investing and the first trade each month is free. Trades are when you buy and sell funds or shares within your account.

- This year ii introduced its Investor Essentials plan to to be more cost effective for investors with less than £30k (rising to £50k from 1St September 2023). The plan costs £4.99 per month and includes free regular investing. While the fee is half of the Investor option, it’s still worth doing the sums. For example, if you’re investing £5,000, your fees are £59.80 a year, in other words you are paying 1.19% of your investment, which is much higher than some others in the market.

- The Super Investor plan is the most comprehensive and is aimed at experienced investors who trade more regularly. It costs £19.99 per month, for which you get your first two trades free each month, and subsequent trades for £3.99.

- The Pension Builder account is for people with very little in the way of pension savings. For a flat fee of £12.99 per month, interactive investor’s Pension Builder plan is a stand-alone pension plan aimed at the 6.2 million people in the UK who don’t have a pension or want to quickly build and consolidate their pensions. Customers pay a flat £12.99 per month regardless of the size or composition of their investments. For some smaller pensions that might look steep, but as the pension builds up, the flat fee comes into its own.

Overall, the pricing structure is biased towards larger investors. With flat fees, as your investment grows, the fee becomes a smaller and smaller percentage of your total portfolio.

interactive investor’s investment choice

ii prides itself on having one of the best investment ranges on the market. Its website claims over 40,000 UK and global stocks. Here it is difficult to fault it. If an investment is available on the open market, it is probably available on ii.

As a platform, ii is doing a lot of work on Environment, Social and Governance investments (ESG), or responsible investments as you may hear them called. It has put together its ii ACE 40 investments, which is a list of the 40 best-in-class sustainable investments from the 200 available on platform. ACE stands for Avoids, Considers and Embraces. These are different ways of looking at and measuring sustainable funds. It is a good initiative and certainly gives you the introduction you need if you’re looking at sustainable investments for the first time.

If you don’t want to do the research and spend time looking at investments, after all, there are only so many hours in the day, then you can check out ii’s Quick Start funds. These are six ready-made portfolios that you can choose from, depending on your investment objectives and risk appetite. Three are provided by industry heavyweight, Vanguard and the other three are sustainable portfolios built by Canadian firm, BMO.

interactive investor’s support and guidance

One thing that you won’t be short of on the platform is content! ii comes from a background of providing research to the investment community and offers a great suite of videos, podcasts and helpful guides through its Knowledge Centre. The YouTube channel also hosts a Family Money series featuring a different celebrity each week, so you can have some fun learning about a celebrity’s finances!

However, unlike some of competitors, ii does not offer any kind of advice service. This is not necessarily unusual for a direct-to-consumer service, but there has been an increase in different forms of advice or investment coaching available in recent years from firms like Hargreaves Lansdown and Bestinvest. It is a shame that ii do not have an equivalent service, though that’s not to say it couldn’t in the future since it has the scale and capabilities to do so.

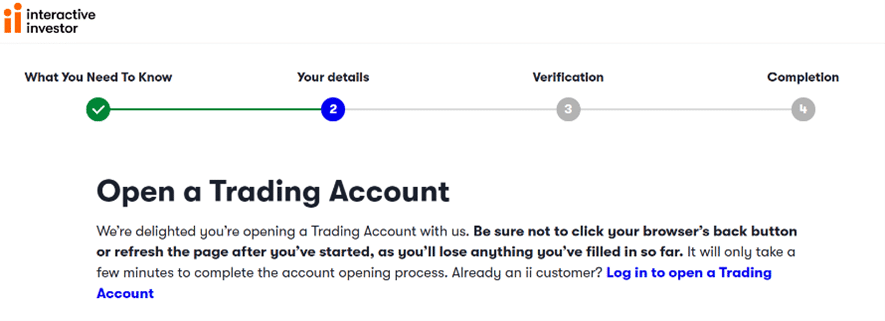

Setting up your interactive investor account

The setup process is everything we would expect from a platform. There are a few things its handy to have nearby when you’re going through this process to make it quicker and easier. These include your personal details, National Insurance (NI) number, debit card details and any second passport/ nationality information.

Once you have completed the registration process and chosen which type of account you would like to invest in (such as trading account, ISA or Sipp) you can get started and begin investing.

The pros and cons of interactive investor

There is comfort to be had with the platform being big, established and experienced, and having a well-funded owner. It knows what it’s doing and isn’t a startup that might not exist in a few years.

Thanks to its background in investment research, ii is probably one of the best for content in the market, with a wide breadth of material to digest when researching and learning about investments —you don’t have to go hunting in the financial press to get your latest insights and tips.

When it comes to investment choices, you’re not restricted either. It has one of the widest ranges available in the market. But if you find too much choice bewildering or overwhelming, it has ready-made options too.

What are the cons? Interactive investor charges flat fees and that can be a big disadvantage depending on how much you’re looking to invest. Even with the lower-priced options, it can still add up once you include trading fees and other charges. The pricing really works best for larger investors (£50k+) who can take advantage of flat fees.

The lack of advice is perhaps surprising for a firm of ii’s size, but a lot of people clearly like the service just as it is. Overall, interactive investor is a comprehensive place for direct investors to go to but be careful with what you’re paying for your level of investment.

Last checked and updated on 9th August 2023.

Photo by Denvonju on Canva